Trade Like a Quant Without Spending Your Life on Charts

The Multi-Asset Adaptive Engine™ Finds the Highest-Probability Setups Automatically

Fully Automated - No charts, no decisions, no emotions

Your Money, Your Control - Stays in YOUR broker account

20-Minute Setup - Then just 5-minute weekly checks

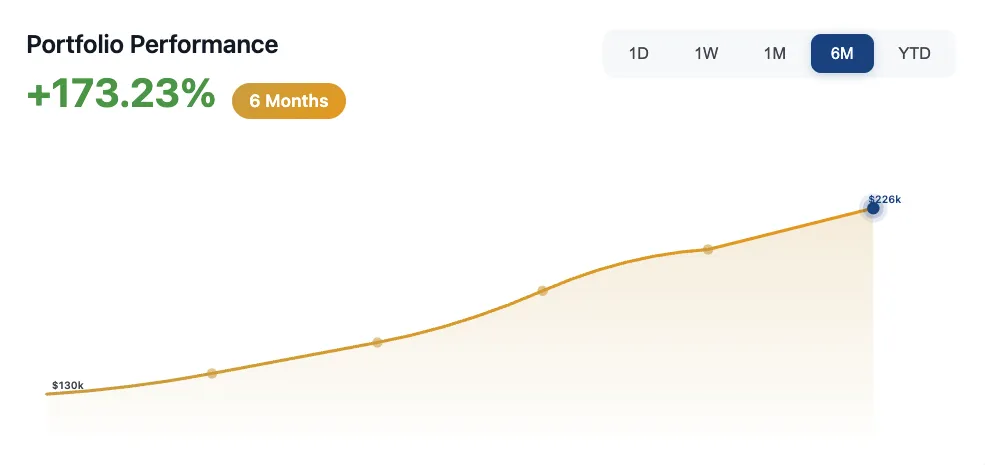

Verified Performance - third-party audited results

The Brutal Truth About Your Trading Strategy

Your results don’t suffer because you’re “bad at trading.”

Your results suffer because the market you trade stops giving clean setups… and your strategy doesn’t adapt.

Does this sound familiar?

Your strategy works in trends, but gets destroyed in chop

You miss the volatility because you're at work, asleep, or busy

You get emotional after 2–3 losses and start breaking rules

You overtrade because you’re bored

You undertrade because you’re scared

You rely on ONE asset class for all your trades

Everything breaks when volatility shifts and you’re forced to sit through drawdowns, stopped-out trades, and ugly chop until “conditions get better.”

That’s not trading. That’s gambling.

Meet the Multi-Asset Adaptive Engine™

The only retail-accessible algorithm designed to trade the cleanest opportunities across multiple asset classes all in one system.

Instead of forcing trades on one dead asset, the engine continuously analyzes:

Market regime

Volatility cycles

Trend strength

Liquidity zones

Correlation breakdowns

Macro sentiment shifts

And then automatically rotates to the asset class with the highest probability edge.

Why Traders Are Calling This the Most Advanced Retail Algo in 2025

Your Capital, Your Control

Funds remain in your brokerage account

No pooled investment vehicle or fund structure

Direct ownership of all positions

Complete transparency in your MT4/MT5 account

Quantitative Approach

Built by professional algorithmic developers

Independently verified live performance

Thousands of trades tracked transparently

Designed for growth-focused traders with real capital

The Systematic Advantage

Algorithmic execution eliminates behavioral bias

Trades three asset classes, not one

24/5 market coverage across global sessions

Monthly compounding versus annual in traditional markets

Suitable for traders who:

Are tired of inconsistent manual results

Want long-term growth, not short-term adrenaline

Want to trade smarter, not harder

Know they need a quantitative edge to win consistently

Minimum Capital: $10,000 recommended for optimal position sizing

Account Structure: Individual brokerage account with MT4/MT5 required

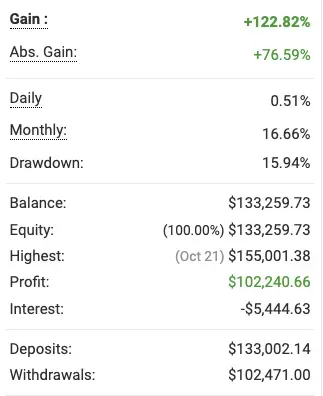

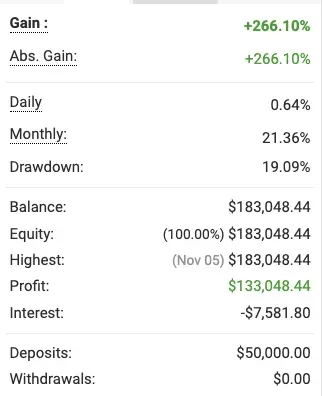

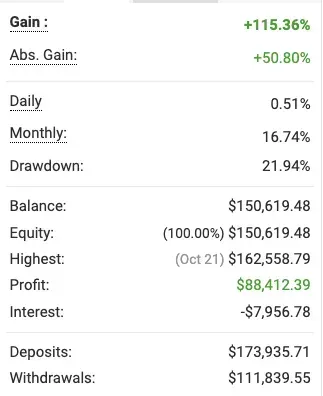

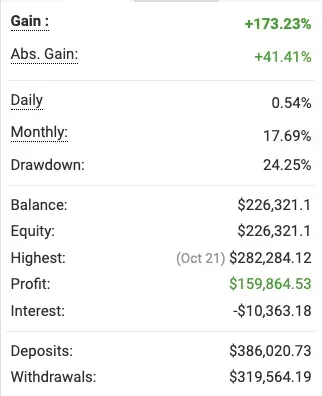

Verification: All trades audited via MyFxBook

This Is NOT for Prop Firm Traders

If you're looking to flip a $100K demo account, chase crazy lot sizes, or pass FTMO challenges… this is not the system for you.

This is built for real traders with real capital who want stable + scalable growth

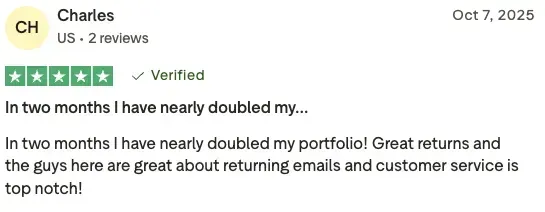

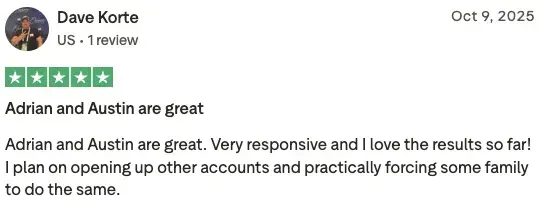

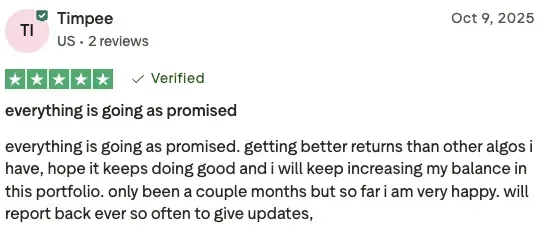

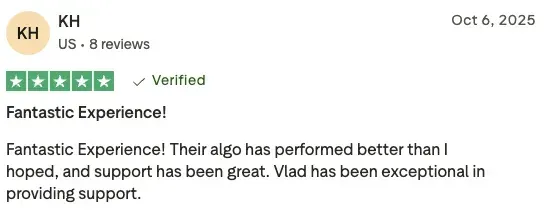

What our clients say

Verified Results

All trades audited via MyFxBook

Copyright 2026. All Rights Reserved White Glove Inc.

This site is not part of, or endorsed by, Facebook, Google, Snapchat, TikTok, Twitter or any social media platform in any way.

Kindly be advised that engagement in the foreign exchange market carries a substantial degree of risk and may not be suitable for all prospective investors.

The volatility of currency values can be considerable, and investors may encounter losses surpassing their initial investments. Prior to participating in the foreign exchange market, it is imperative to conscientiously assess your investment objectives, level of expertise, and risk tolerance.

Moreover, it is crucial to acknowledge that the foreign exchange market is susceptible to a multitude of factors beyond the control of individual investors, encompassing economic and political events, fluctuations in interest rates and exchange rates, and other global occurrences. These elements may exert influence on currency values, potentially resulting in significant financial losses.

The information provided herewith is intended solely for educational purposes and should not be construed as investment advice. We strongly recommend seeking independent financial counsel prior to making any investment decisions. Additionally, it is essential to recognize that past performance is not necessarily indicative of future outcomes.

Please be aware that you bear sole responsibility for any investment decisions made, and White Glove Inc. shall not be held accountable for any losses or damages arising from reliance on the provided information or any investment decisions based thereon.